How to Accelerate Growth in Global Markets

AppLovin recently hosted a digital event series Going Global in China to help Chinese developers better understand overseas markets and prepare them for success. In this series, we brought together industry experts and successful developers to discuss trends and opportunities in the 3 top markets: NAM/EU, JP/KR/SEA, and LTAM.

Learn from their extensive experience in different markets and gain insight into publishing, marketing, growth strategy, and more in the highlights from each episode.

Episode1: How to Conquer the NAM & EU markets

In the 1st episode, guest speaker Bob Wang, Overseas Marketing Manager at FunPlus, shared his experience with launching a game in the US market, as well as the operation and growth strategy of SLG games.

The US is one of the most lucrative and mature app markets in the world and second largest market for SLG games, right behind China. High user LTV and pay rate has made the US the most appealing and competitive market for gaming companies. Although user acquisition cost is high in the US market, long-term retention rate is also high and ideal for long-term revenue.

For SLG games, most revenue comes from the top 20% users, so the budget will be tilted towards high paying users and users who make in-app purchases — but this doesn’t mean the remaining 80% of users aren’t important.

To build a healthy ecosystem for the game, it’s essential to acquire users through audience targeting and machine learning to gain more effective DAUs. Ad platforms can help you find a large number of users — but finding the right users is key.

AppLovin’s technology uses machine learning and predictive algorithms to match the right users with your app and automatically optimize campaigns based on your ROAS goals, which leads to more stable performance and saves UA team hours of work manually managing campaigns.

Episode2: How to Conquer the JP/KR/SEA markets

Japanese developers New Story and Pangle joined this episode to share insights into the Japanese market and strategies for scaling globally.

In Japan, the competition among IAP games (games that are heavily dependent on IAP revenue) is especially fierce because a large number of gaming companies focus on IAP games — so you need to be smart to survive in the Japanese market. And there are still a lot of untapped opportunities for games that rely on IAA revenue.

Globally, the hyper casual games market is highly competitive and one of the biggest challenges is how to innovate within common game themes and mechanics to make your game stand out from the crowd.

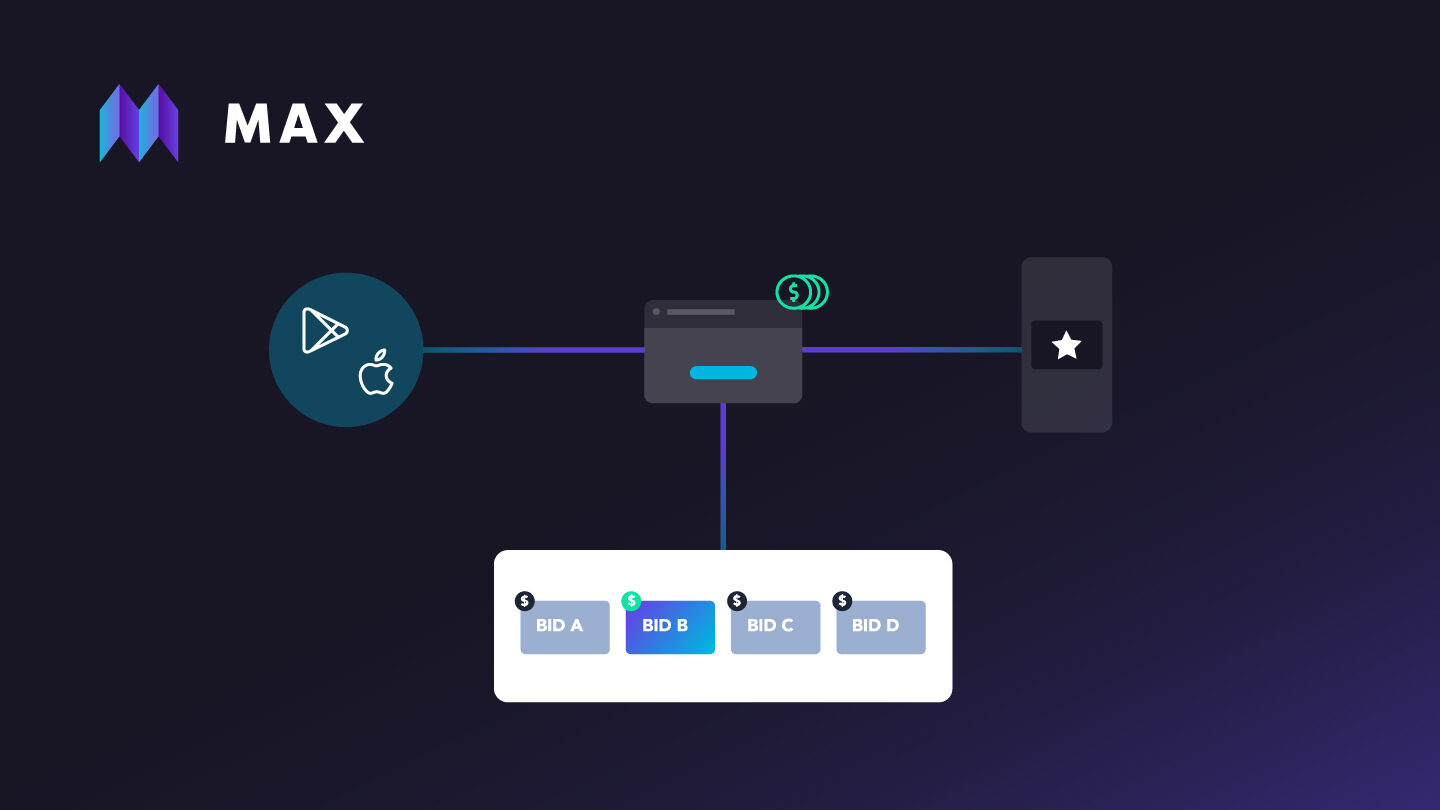

With only 6 people, New Story was able to launch many successful games in less than 2 years thanks to their efficient operations. MAX’s in-app bidding helped the team save a lot of time through automated workflows so the team could focus more on game development. With MAX, they greatly improved the overall efficiency and achieved global success.

In order to maximize revenue and expand to overseas markets, New Story used AppDiscovery’s optimized Ad ROAS campaign in conjunction with MAX’s powerful monetization features to increase sales by a staggering 1000%. Yusuke In, CEO of New Story, further added, “if you want to grow your app in a short period of time then you are going to need a very efficient UA tool, and this is when the Ad ROAS campaign comes in and does its magic.”

Watch the video recording to hear more from New Story’s tips and best practices.

Episode3: How to Conquer the LATAM markets

In the last episode of the series, Adjust and AppGrowing joined us to discuss the rapidly-growing LATM market and shared UA best practices for both gaming and non-gaming apps.

With the advantage of a young mobile first population and high smartphone penetration, the LATAM market is worth exploring and expanding into, and it has a lower acquisition cost compared to top markets including the US, EU, Japan, and others. In Latin America, games, entertainment, and social apps are the most popular and the best-performing apps typically have more revenue generated from in-app ads than in-app purchases.

When it comes to data analysis, advertisers need to pay close attention to ROI, LTV and ROAS and use the data to further reduce user acquisition cost and increase revenue.

For apps that rely heavily on in-app ad revenue, we recommend starting with a CPI campaign. Once the number of installs reaches 4,000-5,000, you can turn to an Ad ROAS campaign for optimized results. For apps that are more dependent on in-app purchase revenue, send IAP data via your MMP to begin the process.

Wondering how you can leverage AppDiscovery to target high-quality paying users and crush your ROAS goals? Check out ONEMT’s story here!

If you’d like to learn more about the LTAM market, watch the full episode of AppGrowing’s presentation and a panel discussion with AppLovin and Adjust.

What 2022 Holds for Us

Some trends and suggestions shared by the speakers for 2022:

- With the deprecation of IDFA, it’s highly possible that the device ID on Android will no longer be available soon. Acquiring users effectively without device ID will be a key challenge in 2022. In addition to data tracking and attribution solutions, we need to be prepared to explore more in terms of user tags, game development, game branding etc,.

- The competition of casual games will increase and hybrid monetization will be a big trend this year.

- CPI campaigns will not give you much of a competitive advantage because many advertisers started running optimized campaigns, including Ad ROAS, IAP ROAS, and CPE campaigns.

- The Southeast Asia, India, Indonesia, and Latin America markets will definitely increase and become more competitive — so act fast if you intend to grow into new markets.