Hyper-casual: Mobile gaming’s newest genre

In 2017, I wrote a three-part series on PocketGamer.biz called “The Ascendance of Hyper-casual,” where I dissected the emergence of hyper-casual as a new genre in the mobile gaming space.

In part one, I defined three general categories that mobile games have been broken down into: casual, mid-core, and hardcore. The first games launched on iOS were paid casual games. Casual games are straightforward with mass appeal—think Candy Crush. Casual games were followed by mid-core games, which are characterized by a recognizable design along with adapted controls and metagaming. Around the time mid-core gaming came around, UA teams started using cross-promotion and ad networks to acquire players.

The last category I covered was hardcore games, where there are fewer users who play less frequently, but conversion costs are higher. For hardcore games, social networking is a part of the game, as well as the monetization strategy. Monetization of hardcore games is reliant on the commitment of the players, and it is largely whale-driven, which means developers make most of their revenue from a handful of dedicated players.

The dawn of the hyper-casual genre

In part two of the series, I introduced the new genre “hyper-casual”, which includes games that are lightweight and instantly playable. They’re often addictive, because gameplay is just a tap away and sessions are short, allowing players to play frequently and stop at any time. UI for these games tends to be minimalistic—they’re sort of a revival of simple arcade games from the ‘70s and ‘80s.

But beyond the minimalist design, the biggest reason for the success of the hyper-casual genre was because of the maturation of the mobile games industry. When the App Store first debuted a decade ago, mobile games were predominantly paid premium experiences. Games like Crash Bandicoot and Rolando commanded premium prices for their experiences, taking the PC and console monetization approach to mobile.

Then came Angry Birds and its $0.99 price tag, sparking a race to the bottom for mobile game pricing. Consumers became acquainted with paying little to no money for games, ushering in the era of free-to-play games, which relied on the aforementioned whale-driven monetization strategy.

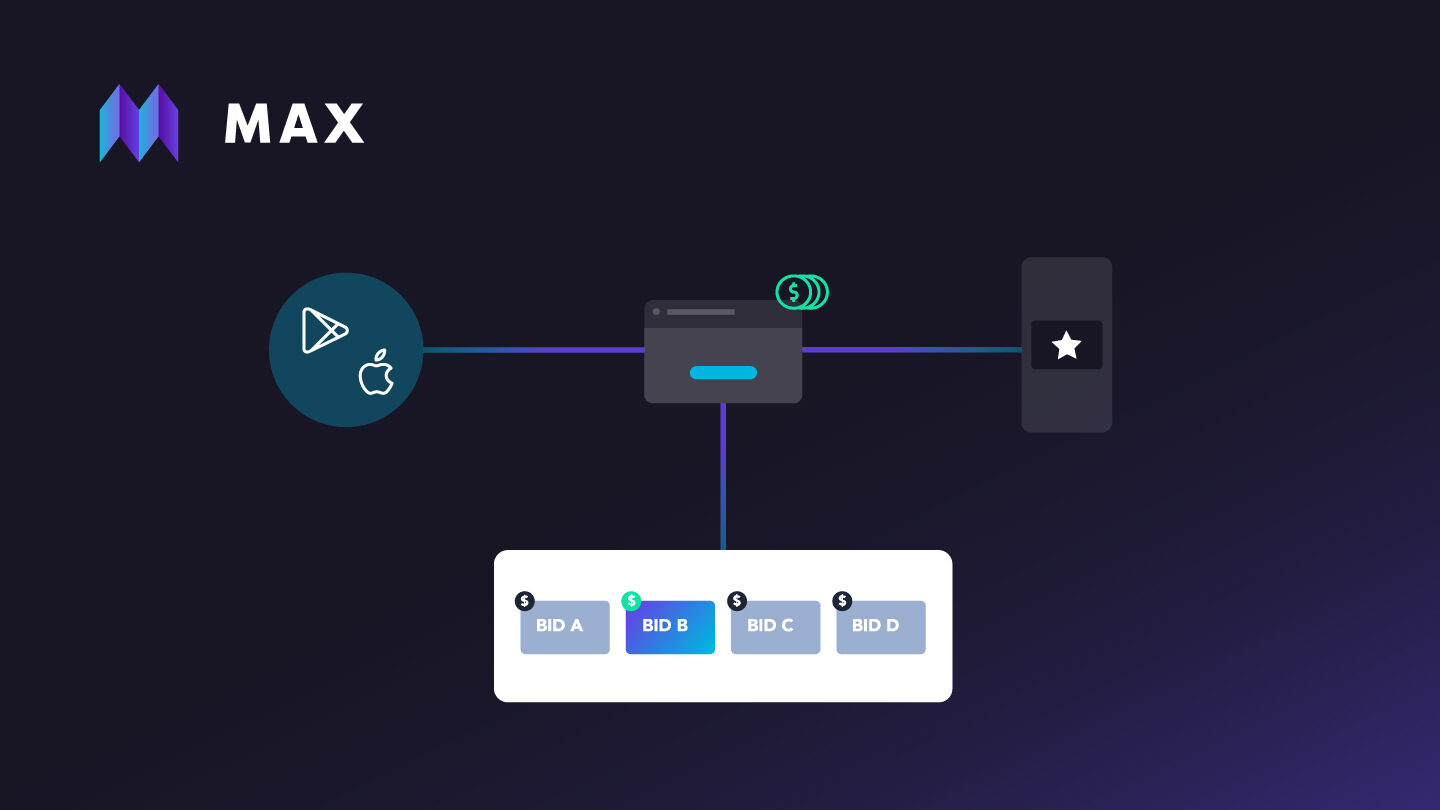

In contrast, hyper-casual games generally offer few in-app purchases (IAPs), which usually account for more than 70% of revenue for other genres, and instead monetize through a mix of video, playable, banner, and interstitial ads. This yields relatively low revenue per active user, but the mass appeal and “stickiness” of the games makes up for it in scale. With this monetization model, user acquisition is more important than ever and there are best practices developers must follow.

Monetization strategies for hyper-casual games

In part three, I explained that because the majority of monetization in hyper-casual games is through ads, quality is important. It’s crucial to maintain a good user experience while maximizing player touchpoints with ads, and this requires optimizing the frequency and format of ads. Often, the best option is a skippable video after one or several of the most prominent game loops.

Love Balls offers up a skippable video after several core game loops.

Players of hyper-casual games can be acquired at extremely low rates, so even though CPIs are increasing and gaining traction in the app stores is difficult, developers of hyper-casual games have a lot of opportunity. Hyper-casual games tend to be less costly to make, and players monetize almost immediately since ads are the primary revenue source, meaning that UA campaigns can be optimized early on. Hyper-casual games make the biggest share of revenue in the first couple of days, unlike IAP-heavy genres, where the most active users make the most money over time.

Learn more about hyper-casual games from our previously recorded chat with developer Voodoo in the video above.

With any game genre, players will always want more content. With hyper-casual games, it’s feasible to build a portfolio and cross-promote your brands, allowing them to essentially support themselves. Hyper-casual games offer opportunities to mobile game developers that previous genres didn’t. Because of the snackability of content that hyper-casual games offer players, as well as their relative ease of development and optimal setup for continued monetization, hyper-casual games will likely be a huge driving force behind mobile gaming for years.

The hyper-casual momentum

2017 was the year hyper-casual games started gaining steam and the momentum isn’t stopping. We predicted that the hyper-causal genre would shake up the top app charts in 2018 and we’re actually seeing that play out. As of the time of this writing, four hyper-casual games (Hello Stars, Ultra Sharp, Tomb of the Mask, and Bumper.io) make up the 1st, 2nd, 3rd, and 4th positions in the App Store Top Free apps chart. Additionally, 8 of the top 10 free games in the App Store are hyper-casual titles. This puts hyper-casual games up there with YouTube, Facebook Messenger, and Snapchat in the Top Free app charts.

But now that the secret of hyper-casual games is out, competition will be fierce among hyper-casual game developers. Even with increased competition, we’re already seeing the influence of hyper-casual on the rest of the mobile gaming industry. In 2016, gaming giant Ubisoft purchased hyper-casual game developer Ketchapp. More recently, hyper-casual studio Voodoo received $200 million in investment from Goldman Sachs and Zynga acquired hyper-casual studio Gram Games for $250 million.

This is just the beginning for hyper-casual. It will be very interesting to see how the mobile games market evolves over the next 12 months as more games embrace ad monetization exclusively.